SIAA Columnist Part 5: Industry 4.0 And The Global Value Chain

In a manufacturing value chain, all the steps of each process centre share a single goal - Increase value to the customers or improve the manufacturer’s advantage in the marketplace. In Industry 4.0 enabled value chains, product development, production, and logistics processes are combined intelligently across company boundaries. In Industry 4.0 maufacturing environments, forward-looking enterprises don’t fixate on speeds and feeds of the machinery. They focus more on how smart assets and manufacturing methods can drive revenue.

Digitisation versus Digitalisation

Many manufacturers engaged in pioneering Industry 4.0 adoption efforts have arrived at an important discovery — the real value of Industry 4.0 manufacturing lies in moving beyond digitisation to digitalisation. The distinction between these terms is not always clear, even Industry 4.0 practitioners confuse them.

Digitisation — Digitisation involves creating a bits-and-bytes version of analogue or physical things, such as microfilm images, paper documents, photographs, and sounds. In smart factories, digitised information can create the virtual equivalents of assembly line components or even an entire factory floor.

Digitalisation — In business, digitalisation takes this transformation process one significant step further. Physical things can be digitised (be represented by a digital twin) but only business operations, functions, models or processes can be digitalised. That is, only processes or activities can be improved by leveraging digital technologies. Only these process improvements can deliver maximum value for the least possible total cost and create a competitive advantage. Defining benefits as process improvements brings us directly to the idea of generating value. More and more analysts view digitalisation as the road on which businesses move from process-level improvements towards digital business and digital transformation. In the world of digital manufacturing, transformation is the Promised Land, where good things start happening. Manufacturers discover new business opportunities and create new revenue streams and offerings. However, these new symbols of a healthy digitalised manufacturing environment come with a hefty price tag; Manufacturing processes will have to be changed, risk adversity will have to be overcome, and existing partner relationships will have to be expanded or changed.

The Smile Curve & the Outcome Economy

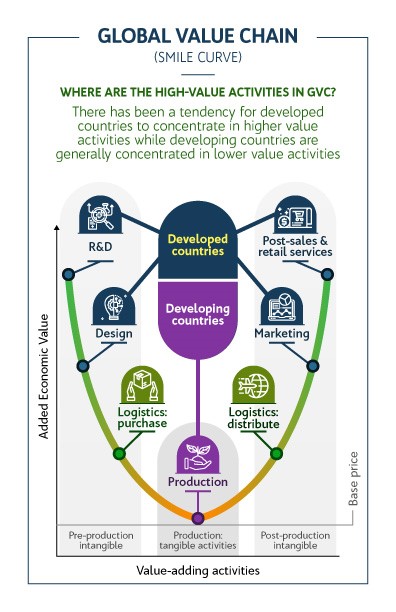

Careful study of the global value chain and classic smile curve as it applies to ASEAN nations provides a vibrant story of international competition and economic development. Advanced countries such as the United States, Japan, and the major EU economies, operate at the high-value end of the product life cycle. These vary from initial concept, design, and branding on one end to marketing, sales, and post-sales services on the other. Moving up the sides of the smile curve — During the past 30 to 50 years, countries with high-value economies outsource the lower-value work in the middle of the smile—manufacturing—to less developed countries such as ASEAN-6 nations and China. Faced with recent increases in labour costs, China is joining the move up the value chain. Now, they too are outsourcing lower-value manufacturing work to ASEAN nations with growing workforces of young people and lower operating costs. The regional Industry 4.0 environment enables ASEAN manufacturers to accept higher-value work. However, the seemingly golden opportunity carries a very big “if.” To remain competitive, ASEAN-6 (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) manufacturers must train or retrain their workforce to competently operate modern manufacturing equipment and processes, and they must complete the training quickly.

Now, digital technologies such as the IIoT, data analytics, and machine learning are making customer-centred manufacturing possible. The challenge for manufacturers is focusing their attention on which their customers are, deciding what they want and how to deliver the products they want. For many manufacturers, making a product still involves assembling components and selling the product. The product’s value lies in the selling price of the item and the efficiency of the manufacturer’s operations. Now, the focus is moving from making a product to results (outcomes) such as customer satisfaction, safety, or comfort. It also involves monetising new stages of a product’s life cycle (marketing, customer support, etc.). For manufacturers in many industries, the outcome-based economy is about: Bundling products and services; Moving from one-time to ongoing transactions; and Enabling subscription-based transactions based on a recurring revenue relationship.

Finding the Value in Manufacturing

It’s well enough to say a manufacturer must start selling more than their finished goods. Unfortunately, it’s more complicated. Business leaders are learning where the value in manufacturing lies and it’s not where they might have expected. The lowest part of added value lies in the manufacturing process itself. Much of the value in a manufactured product lies with concept, R&D, branding and product design at one end and distribution, marketing, and sales and services at the other. The smiling curve (Figure above), created by Acer Inc. founder, Stan Shih, in the early 1990s, illustrates this principle.

Three Levels of Value

When people talk about Industry 4.0, they often mention a two-tier value regime. The first category is what people typically think about value — cost savings, improved worker productivity, and faster times to market. These factors all depend on producing more products, more efficiently. Some analysts call this low-hanging fruit, which can be achieved by improving current manufacturing processes to make products with traditional business models. Value in the second tier, however, depends on new business opportunities. This is where new and existing Industry 4.0 technologies are combined to create new business models and revenue. Finding value in this new frontier of manufacturing requires modern equipment, high-risk tolerance, and a sharp eye for business opportunities.

Manufacturing-related, process-level value — This level describes value generated by process operations and maintenance within businesses:

• Manufacture, maintenance, supply, and distribution costs reduced or avoided

• Improved supply chain transparency

• Lower inventory costs

• Avoiding equipment repair and maintenance costs

Business-level value — Our next focus of interest lies several levels up the manufacturing hierarchy from processes to the enterprise (at the RAMI 4.0 business layer). This is where you find the total value of products and services generated by a business. The examples are familiar to every MBA student:

• Revenue added via new products, services, or business opportunities

• Revenue recovered from productivity lost to inefficient operations

• Higher revenue, enabled by improved productivity

• Improved production and worker productivity

• Improvements in the quality of goods

• Greater customer satisfaction and loyalty

• Faster product time to market or time to service

• Faster response to customer preferences and requirements

These types of value aren’t just measurements of financial performance. They also serve as indicators of potential value growth and business opportunity.

National-level value — Just as value, in general, can indicate opportunities at the business level, value in national level manufacturing activities identifies benefits beyond the enterprise. These difficult-to-quantify metrics reflect improvements in education, technological development, and quality of life:

• Provide modern consumers with satisfaction enabled by advanced products and services that they crave

• Improve wages and living standards for the nation’s people

• Develop a workforce with skills in new fields such as data science and analytics, data engineering, and agile manufacturing applications

• Improve innovation in fields such as analytics and advanced production automation

• Create a strong local demand for Industry 4.0 components (IoT, analytics, etc.), which helps companies build capabilities in these areas.

About the Columnist

Industry veteran Colin Koh is our monthly columnist to share with SIAA community the essence of ASEAN manufacturing and pragmatic tips on how to approach and navigate the fourth industrial revolution for their businesses. Stay tune to Colin's regular segment all about Smart Manufacturing 4.0 in ASEAN! Please visit www.asean4ir.com more resource.